Improving technology tools are enabling criminal gangs to execute more complex frauds; a technology-based strategy is the only practical response if banks are to succeed in safeguarding their brand reputation and customer trust.

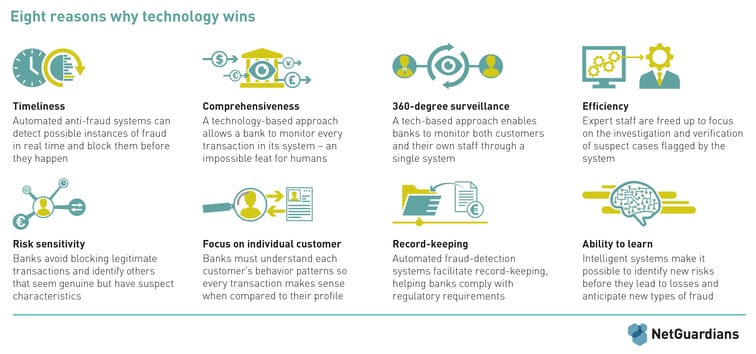

Advanced anti-fraud systems offer critical strengths in banks’ fight against fraud. Using the eight key strengths below, it is possible to set out an effective solution to digital banking fraud based on technology tools available today. In our latest eBook on digital banking fraud, we’ve outlined those strengths as:

|

|

Fighting against fraudsters is a continuous cat and mouse game. However, with the recent advances in machine learning and artificial intelligence, we’ve managed to move out of this game and significantly improve banks’ fraud prevention capabilities even for new fraud types. The future looks promising. In my next blog post, I will provide the detailed outlines for a tech-led solution. Stay tuned!